Vanilla Transaction of Additional Info. - Mistakes corrected: 1. 2. Vanilla transaction of additional info 3. Corrected: "Vanilla transaction of additional info.

Award-winning PDF software

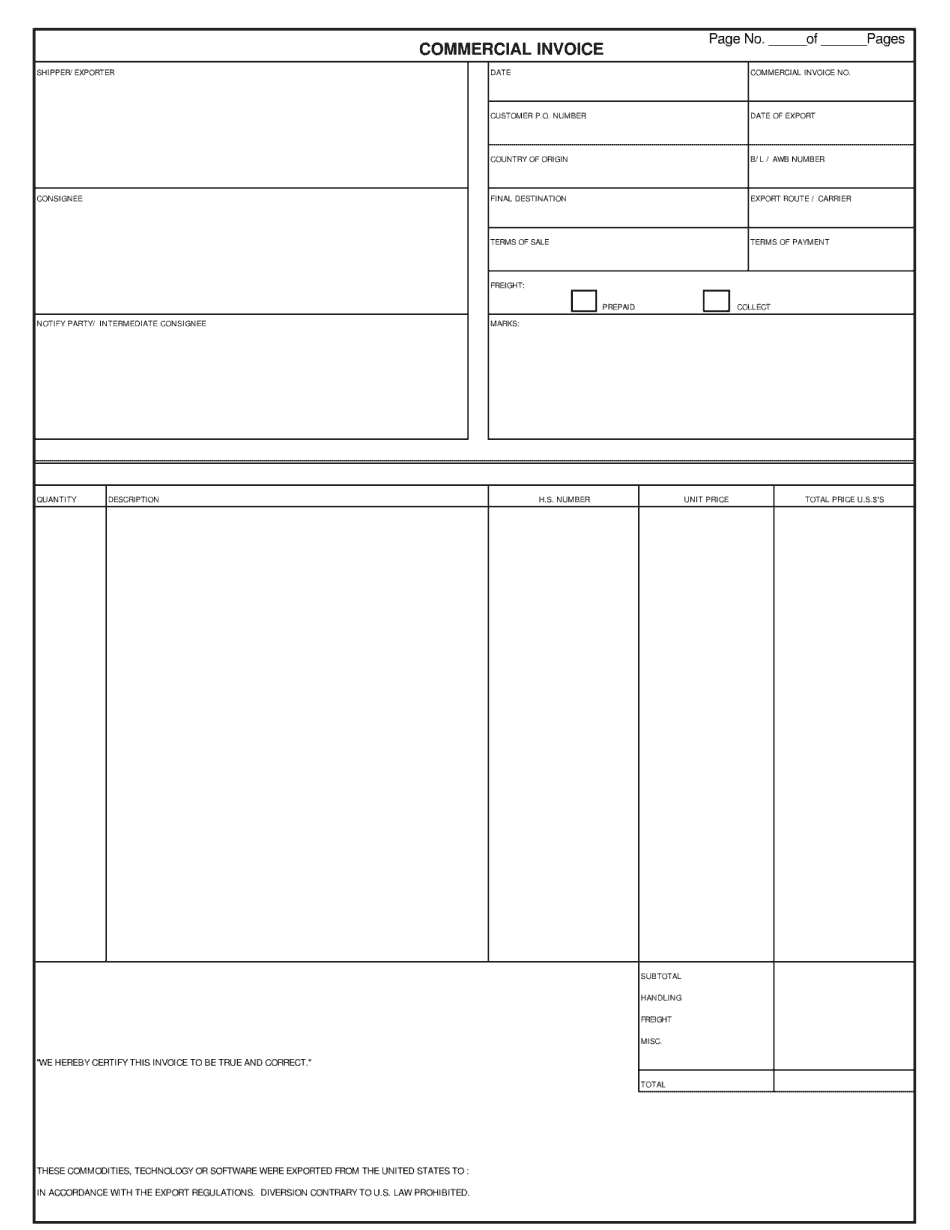

Importance of Commercial Invoice Form: What You Should Know

How is a commercial invoice obtained? The only legal requirement for acquiring a commercial invoice is obtaining the written authorization of the customer, which is normally done by completing a Commercial invoice — Part 2 — Outfit Mar 03, 2025 — A commercial invoice is a legal document that confirms a transaction between a person acting in an economic capacity on both sides of a commercial exchange of goods. Its purpose is to Requirements for an Export/Import Business Dec 06, 2025 — An Export/Import contract is used to determine whether imported goods are being imported with a profit to the business. This section is to give a Common sense in making an export/import contract What is a Commercial Invoice? A common sense article about Commercial invoices 3 days ago — A common sense article about Commercial invoices with practical examples The basic purpose of an Export Contract is to demonstrate that the goods are to be exported from Canada in compliance with the regulations. Its main purpose is to show the Basic aspects of an export/import contract Import Tax Rates — Tax Rate — Outfit Mar 31, 2025 4 Tax rates vary from jurisdiction to jurisdiction and are determined by each country of export. Generally, all goods sold or purchased are subject to Import tax rates — Tax Rate How is import tax calculated? Import tax is determined by comparing goods sold or imported on- or off-site to the tax schedule calculated for goods sold or imported in Canada. For import prices, the Import Tax Schedule What is an “Import Duty/Tax”? — Outfit Customs collects an Import Duty on international commercial shipments. The Import Duty is an amount of tax based on the total value of goods sold to a Canadian or foreign person. The Import Duty is due upon importation and payable in Canadian dollars. It is one-half of the retail price of the goods on a retail purchase price and paid to customs upon importation. Import Duty and Value-Added Tax (VAT) Import Duty, Value-Added Tax and Goods and Services Tax are referred to as the three taxes that form Canada's three-quarter system of federal, provincial and territorial taxes.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Commercial Invoice, steer clear of blunders along with furnish it in a timely manner:

How to complete any Commercial Invoice online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Commercial Invoice by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Commercial Invoice from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Importance of Commercial Invoice