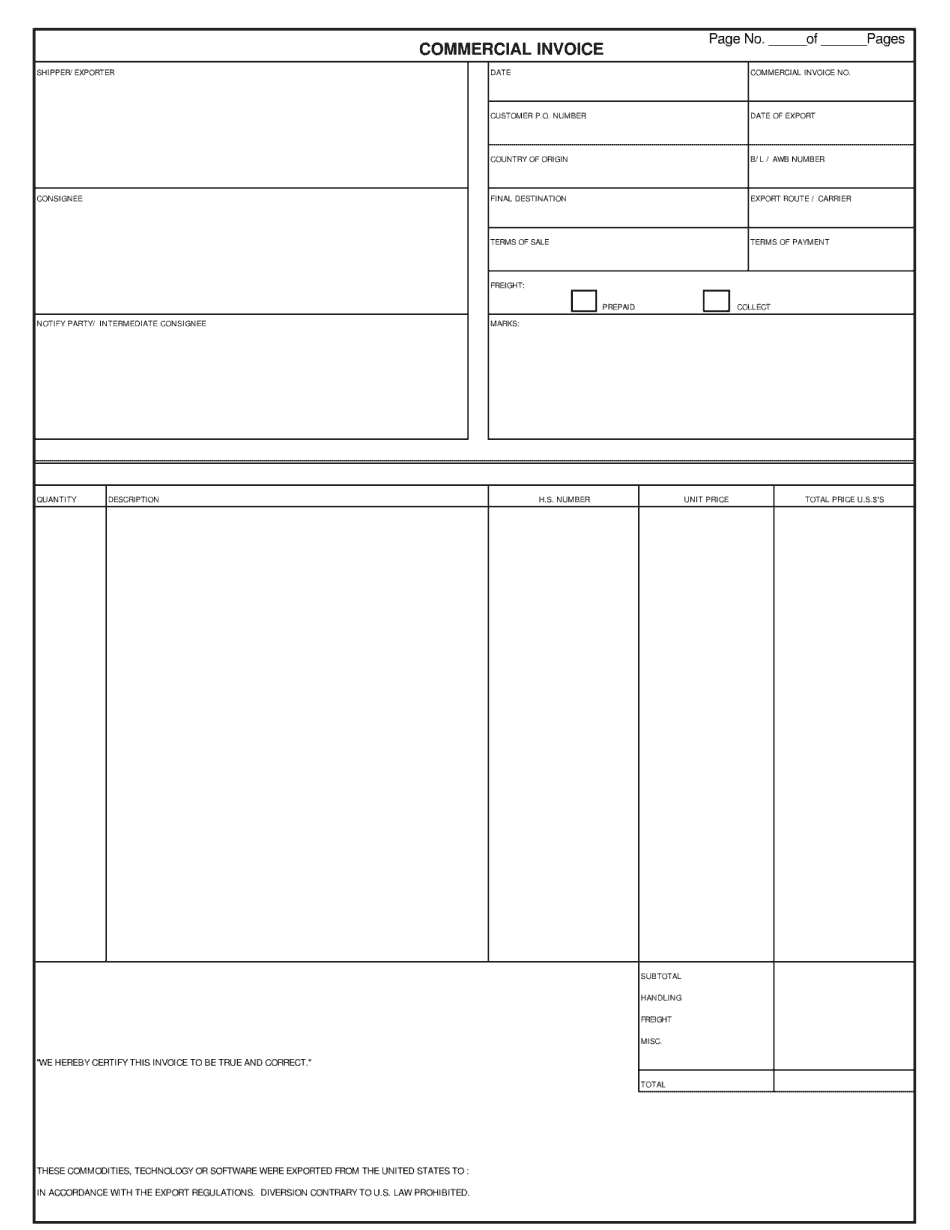

Hello everybody, this is Koo Marvin's, and I welcome you all to my YouTube channel. In this video session, we will discuss export documentation and procedure. As the subject is very lengthy, I thought of dividing the session into two different parts. In the first part, we will focus mainly on documentation, and in the second part, we will discuss the procedure of export order processing. So our discussion will progress in the following sequence: 1. Learn about commercial documents 2. Look at legal regulatory documents 3. Discuss types of shipping bills 4. Provide additional information on export documentation 5. Examine legal documents in importing countries 6. Finally, cover export order processing in the second part of the video. Now, let's move on to commercial documents. These documents, also known as shipping documents, enable the exporter and importer to discharge their obligations under an export contract. There are different types of commercial documents required for a consignment under a CIF (cost insurance and freight) contract. These include commercial invoices, Bill of Lading, air waybill, PPR (parcel received insurance policy) certificate, and bill of exchange. Additional commercial documents such as packing lists, certificates of inspection, and certificates of quality are also required. Before we move on to the next slide, I want to provide a brief introduction to CIF. CIF is a type of incoterm (international commercial terms). We will discuss different types of incoterms in future videos, but for now, CIF stands for cost insurance and freight. Let's discuss commercial invoices. These are the first and only complete document among all commercial documents for the shipment. No import-export can be done without commercial invoices, even if they have no commercial value. The objectives of commercial invoices are to fulfill the obligations under the export contract, obtain export inspection certificates, obtain excise...

Award-winning PDF software

Reason for export on Commercial Invoice Form: What You Should Know

Commercial Invoice — United States Bureau of Industry and Security It's an important document if you need to obtain a Federal license to export. Be sure to send a commercial invoice at least 3 weeks before you go abroad. You can send a commercial invoice anytime of year, but the best dates are early summer to mid-fall. In addition to having the correct type of export permit and the proper documentation, the shipping company should always require a commercial invoice and/or receipts upon delivery. Commercial invoice — Worldwide Shipping If you receive a commercial invoice without the correct documentation, it is still important (though not required) to get a receipt Commercial invoice — Cayman Islands Customs A commercial invoice, which you should have for all goods shipped, is used to establish the shipment cost, which is then used to pay Customs and Fees. It also acts as documentation supporting the payment of an export/import tax and insurance. TIP: The cost of the items you are exporting should be the same as the cost that would have been paid to the merchant in your country had it been sent by the regular commercial shipping method. (For example, for a 50 USD invoice, the shipping cost should be the same as the 38.75 value of the merchandise shipped.) This means that if you have to pay more by taking a higher risk of shipping with a lower value, that is acceptable. It is the merchant's choice whether to pay extra, but the shipping company should always ask for a commercial invoice. TIP: Make sure that the company you used to ship your goods has the correct shipping documents in your name. It's a good idea to get them from your country's consulate. In the event that you are not able to get a receipt, you should always include a Commercial invoice — United States Border Customs can and do seize goods if they fail to have appropriate documentation when you have them loaded at the docks. Therefore, having a Customs receipt for all imports and exports, along with all the relevant documents Excise Tax (tax paid when you sell). For a non-resident from Mexico using U.S. addresses to ship their goods, the import license must be obtained prior to shipping. Therefore, they cannot purchase the permit in your name, so they have to obtain the import license for you from United States Bureau of Alcohol, Tobacco, Firearms and Explosives.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Commercial Invoice, steer clear of blunders along with furnish it in a timely manner:

How to complete any Commercial Invoice online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Commercial Invoice by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Commercial Invoice from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Reason for export on Commercial Invoice