Award-winning PDF software

Repair and return process in customs india Form: What You Should Know

Application for refund of duty or other duties or interest(135 KB) where goods are imported for repair, recovery or replacement of goods with respect to which a duty has been paid in respect of the importation with an importer Import Exports Tax (GET). The Excise Customs Duty will be charged on import of the goods above indicated in respect of the goods (except of goods below stated). Excise duty can be charged on Import and exit of the same. There is provision that the excess chargeable Customs Duty will be paid in the same amount, as customs clearance, for import of goods Excise duty is charged on import of such goods, excluding freight and handling charges. Excess duty on import may be paid in the amount, which would yield a tax benefit to the importer For details of any import duties for export goods to India, The Import Export Tax (GET) of 7% of the tax paid on the total import duty payable on the goods is payable at the time of departure from India. The excise duty on import of goods above specified is levied at the rate of 7% of the value of the goods as ascertained from the Certificate of Import. GET is payable on all importations of goods except of goods in respect of which the Export Duty has been paid Taxes /fees /duties on importation of Goods to India under Export Administration Agreement of India. Importation of goods of Indian Origin in a mode other than in Form 1/3/7/8, under the export administration Agreement of India, will be subject to tax /tax assessment, and tax /tax relief. The tax rate is currently 15% of total cost of goods (including freight, handling, transportation and all duties and taxes) Tax and Duty Assessment & Relief on the Supplies under Export Administration Agreement of India Exchange Rates The currency of India is the Indian rupee. The foreign exchange rate of India is prevailing exchange rate indicated on the website .

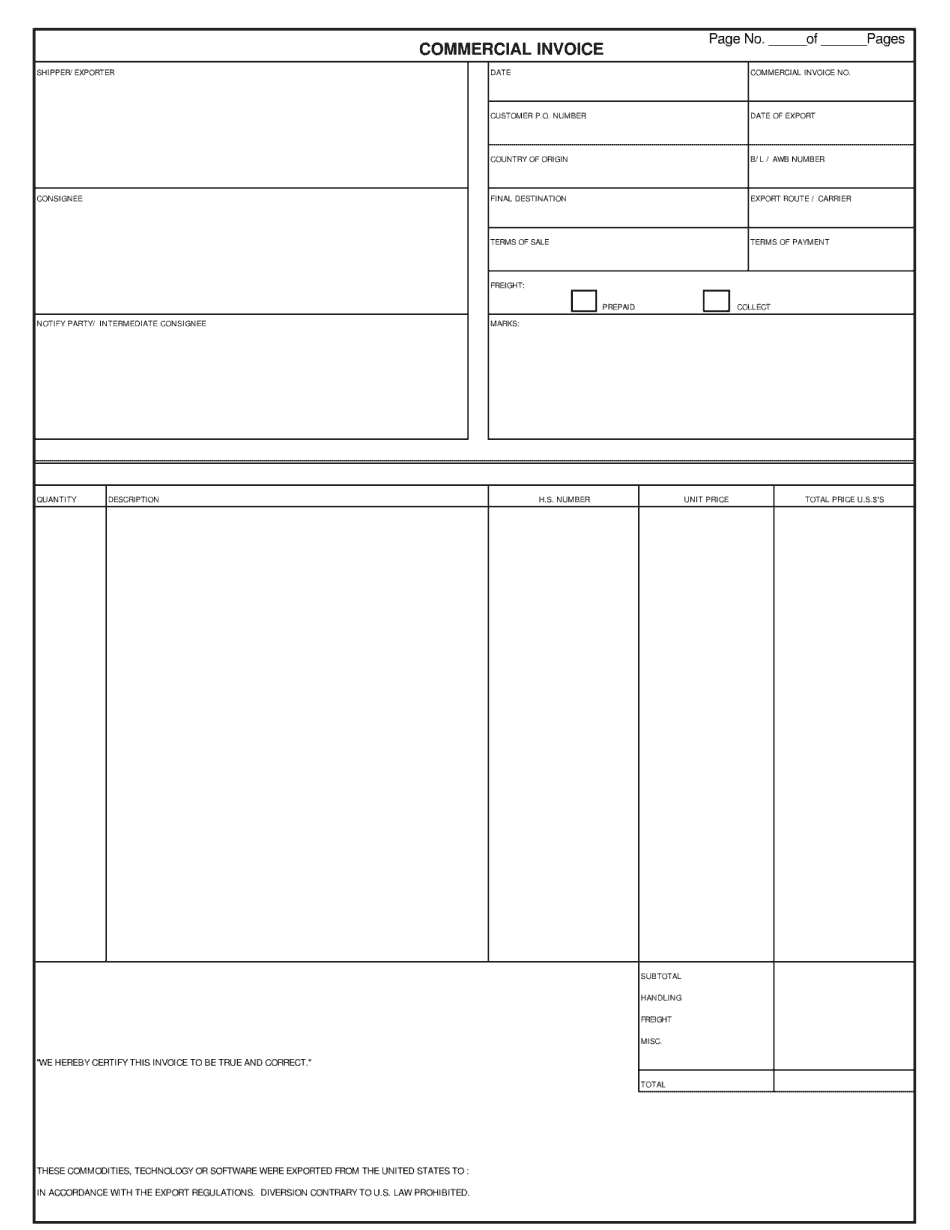

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Commercial Invoice, steer clear of blunders along with furnish it in a timely manner:

How to complete any Commercial Invoice online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Commercial Invoice by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Commercial Invoice from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.